Weekly Column

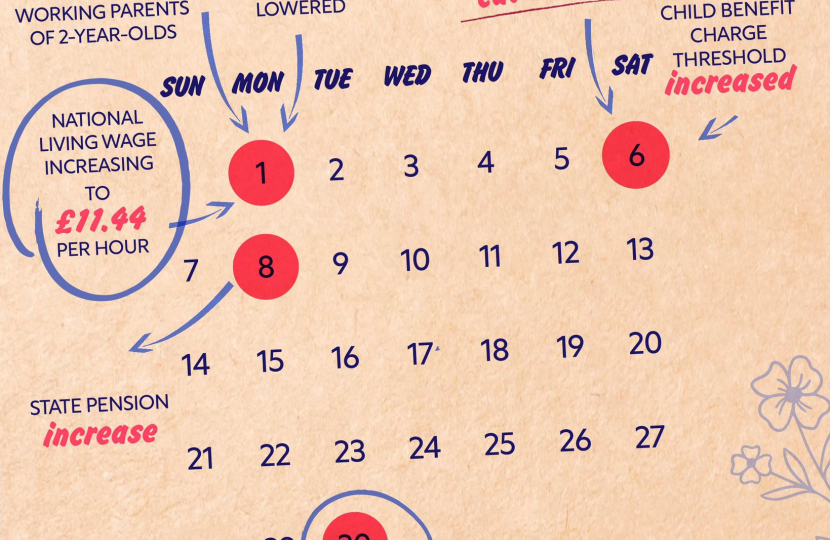

April marks the start of the new financial year which means there is a lot happening this month to cut taxes on working people, increase pensions, boost the national living wage, help families with childcare costs, and help with the cost of living.

From tomorrow, 29 million working people will start benefiting from cuts in National Insurance which are worth £900 for the average worker. A typical police officer will be better off by £1,270 while a typical self-employed plumber will be better off by £846. Bringing down these taxes is possible because of the plan that is working to more than halve inflation from 11.1% to 3.4% and strengthen the economy.

To help those on the lowest incomes the National Living Wage is increasing to £11.44 an hour – an £1,800 increase for a full-time worker. This meets the commitment this government made to increase the national living wage to two thirds of median earnings.

Of course, this brings additional pressures for businesses. That’s why business rates for small businesses and retail, leisure, and hospitality businesses will be frozen or cut to help ease costs. For an average shop this is a saving of £1,650 or for a café of around £5,700 and extending the relief for such premises and pubs will benefit 230,000 properties. Increasing the VAT threshold will help more small businesses.

One of the biggest costs still facing people is energy and it is welcome news that the price cap in place to protect households will fall to its lowest level since Russia’s illegal invasion of Ukraine. This means an average cut of 12.3 per cent in bills. But to help the most vulnerable there will continue to be extra support through the Warm Homes Discount and winter fuel payments, as well as continuation of the Household Support Fund.

An area where more needs to be done is on the standing charges people have to pay whether or not their homes use electricity or gas that day. This is an issue I’ve raised on behalf of constituents and this week the Energy Secretary told the regulator to act to reduce these charges which cost around £300 a year.

Pensions will increase by 8.5 per cent from Monday which will mean an increase of £900. This is in line with the Triple Lock which the Chancellor has confirmed will be recommitted to in the next Conservative Party manifesto.

Finally, this week also sees the launch of the first stage of the expansion of childcare to help parents struggling with costs that can be a barrier to work. Eligible working parents of two year-olds will be able to access 15 hours of free childcare per week. This is part of our plan for 30 hours of free childcare provided for children from nine months until they start school – saving families around £6,900 a year. A plan the Labour Party has chosen not to support.

After unprecedented financial support provided through the pandemic and energy price shock, the measures coming into effect this month will help families, pensioners, and businesses as we strengthen the economy, invest in public services, and bring taxes down.

First published in Lynn News, 5 April 2024